Rocket Mortgage Jewish Loan: Exploring Inclusive Home Financing Options

Outline

H1: Rocket Mortgage Jewish Loan: Exploring Inclusive Home Financing Options

-

H2: Introduction

-

H3: Understanding the Need for Inclusive Home Loans

-

H3: Why the Term “Jewish Loan” Needs Clarification

-

-

H2: What Is Rocket Mortgage?

-

H3: Brief History and Mission

-

H3: Services Offered by Rocket Mortgage

-

H3: Accessibility and Nationwide Reach

-

-

H2: Understanding the Concept of a “Jewish Loan”

-

H3: Definition and Origin

-

H3: Common Uses in the Jewish Community

-

H3: Cultural and Ethical Lending Principles

-

-

H2: Do Rocket Mortgage Loans Cater Specifically to Jewish Borrowers?

-

H3: Inclusivity and Non-Discriminatory Practices

-

H3: Rocket Mortgage Policies on Religion and Lending

-

H3: Financial Assistance for All, Regardless of Faith

-

-

H2: Jewish Interest-Free Loan Associations (JILAs)

-

H3: How They Work

-

H3: Differences from Conventional Lenders Like Rocket

-

H3: Can JILAs Be Used Alongside Rocket Mortgage?

-

-

H2: How Jewish Borrowers Can Use Rocket Mortgage

-

H3: Home Buying and Refinancing Options

-

H3: Working with Jewish Financial Advisors

-

H3: Finding Cultural Comfort in Mainstream Platforms

-

-

H2: Key Features of Rocket Mortgage for All Communities

-

H3: Digital-First Application Process

-

H3: Competitive Interest Rates

-

H3: Flexible Loan Terms

-

-

H2: Combining Faith-Based Financial Help and Conventional Mortgages

-

H3: Using Community Grants Alongside Rocket Mortgage

-

H3: Blending Ethical Lending with Traditional Mortgages

-

-

H2: Alternatives to Rocket Mortgage for Jewish Borrowers

-

H3: Hebrew Free Loan Associations

-

H3: Other Faith-Based and Nonprofit Lending Sources

-

-

H2: Benefits of Using Rocket Mortgage

-

H3: Speed and Simplicity

-

H3: Support Tools and Resources

-

H3: No Religious Requirement

-

-

H2: How to Apply for a Mortgage with Rocket

-

H3: Eligibility Criteria

-

H3: Steps to Get Approved

-

H3: Tips for a Smooth Application

-

-

H2: Important Considerations for Faith-Based Borrowers

-

H3: Ethical Financing

-

H3: Interest-Free Options vs. Interest-Based Lending

-

-

H2: Community and Cultural Resources for Jewish Homebuyers

-

H3: Support Networks

-

H3: Educational Seminars and Legal Aid

-

-

H2: Conclusion

-

H2: FAQs

Rocket Mortgage Jewish Loan: Exploring Inclusive Home Financing Options

Introduction

Buying a home is one of life’s biggest milestones. For individuals in the Jewish community, homeownership can come with both financial and cultural considerations. A popular question among faith-conscious borrowers is whether platforms like Rocket Mortgage offer loans tailored to Jewish values or practices—often referred to informally as a “Jewish loan.”

Let’s dive into this topic and clear up any confusion while exploring options available for Jewish borrowers seeking a mortgage.

What Is Rocket Mortgage?

Brief History and Mission

Rocket Mortgage, part of Rocket Companies, is a digital-first mortgage lender headquartered in Detroit, Michigan. Known for streamlining the home loan process through online tools, Rocket has become one of the most accessible and user-friendly mortgage providers in the U.S.

Services Offered by Rocket Mortgage

-

Home purchase loans

-

Mortgage refinancing

-

FHA and VA loans

-

Jumbo loans

-

Fixed and adjustable-rate mortgages

Accessibility and Nationwide Reach

Rocket Mortgage operates in all 50 states and is available to anyone who meets the general financial criteria, regardless of religion, ethnicity, or cultural background.

Understanding the Concept of a “Jewish Loan”

Definition and Origin

A “Jewish loan” usually refers to interest-free loans provided by Jewish charitable organizations, not a specific religious mortgage product. Rooted in the Jewish value of tzedakah (charity) and gemilut chasadim (acts of kindness), these loans aim to support community members in need.

Common Uses in the Jewish Community

-

Emergency expenses

-

Education costs

-

Small business needs

-

Housing support (in some cases)

Cultural and Ethical Lending Principles

Jewish law (Halacha) often discourages charging interest (ribit) among fellow Jews. This principle has led to the creation of nonprofit Jewish lending associations that provide 0% interest loans.

Do Rocket Mortgage Loans Cater Specifically to Jewish Borrowers?

Inclusivity and Non-Discriminatory Practices

Rocket Mortgage does not offer loans targeted by religion. It is an inclusive financial institution that adheres to the Equal Credit Opportunity Act, which prohibits discrimination based on religion.

Rocket Mortgage Policies on Religion and Lending

Rocket’s policies focus on financial metrics like credit score, income, and debt-to-income ratio. Religion plays no role in eligibility.

Financial Assistance for All, Regardless of Faith

While Rocket doesn’t offer Jewish-specific loans, it provides equal opportunities for qualified applicants from any background.

Jewish Interest-Free Loan Associations (JILAs)

How They Work

JILAs are nonprofit groups that lend money to Jewish individuals and families without charging interest. Repayment is required, but terms are flexible and supportive.

Differences from Conventional Lenders Like Rocket

-

JILAs: No interest, nonprofit-driven, limited funds

-

Rocket Mortgage: For-profit lender, charges interest, larger loan amounts available

Can JILAs Be Used Alongside Rocket Mortgage?

Yes. A JILA loan could be used for a down payment or closing costs, while the main mortgage comes from Rocket Mortgage.

How Jewish Borrowers Can Use Rocket Mortgage

Home Buying and Refinancing Options

Jewish borrowers can apply for any mortgage Rocket offers, just like any other applicant. Whether buying a first home or refinancing, Rocket’s tools are widely accessible.

Working with Jewish Financial Advisors

Some Jewish borrowers consult faith-based financial advisors to ensure the loan aligns with their ethical standards.

Finding Cultural Comfort in Mainstream Platforms

Rocket’s customer service and support tools are inclusive and sensitive to a variety of cultural backgrounds.

Key Features of Rocket Mortgage for All Communities

Digital-First Application Process

From application to approval, everything can be done online.

Competitive Interest Rates

Rocket Mortgage offers rates competitive with top-tier traditional banks.

Flexible Loan Terms

Options for fixed or adjustable rates with terms ranging from 8 to 30 years.

Combining Faith-Based Financial Help and Conventional Mortgages

Using Community Grants Alongside Rocket Mortgage

Some Jewish borrowers use grants from their local synagogue or JILA while still securing a mortgage through Rocket.

Blending Ethical Lending with Traditional Mortgages

It’s possible to reconcile traditional mortgages with Jewish ethics by ensuring transparency and avoiding predatory practices.

Alternatives to Rocket Mortgage for Jewish Borrowers

Hebrew Free Loan Associations

Available in many U.S. cities, these organizations provide small, interest-free loans.

Other Faith-Based and Nonprofit Lending Sources

Interfaith credit unions and nonprofit housing agencies may offer special assistance programs.

Benefits of Using Rocket Mortgage

Speed and Simplicity

Rocket’s user-friendly platform makes the mortgage process fast and straightforward.

Support Tools and Resources

Mortgage calculators, real-time rate checking, and expert consultations are just a click away.

No Religious Requirement

Rocket Mortgage welcomes everyone—what matters most is your credit and financial readiness.

How to Apply for a Mortgage with Rocket

Eligibility Criteria

-

Minimum credit score of 620 (varies by loan type)

-

Stable income

-

Sufficient down payment (typically 3–20%)

-

Reasonable debt-to-income ratio

Steps to Get Approved

-

Apply online

-

Submit documents

-

Get pre-approved

-

Choose a loan and lock your rate

-

Close on your home

Tips for a Smooth Application

-

Organize tax returns and bank statements

-

Monitor your credit report

-

Work with a knowledgeable loan officer

Important Considerations for Faith-Based Borrowers

Ethical Financing

Evaluate loan terms to ensure they align with your ethical or religious values.

Interest-Free Options vs. Interest-Based Lending

Balance practical needs with spiritual beliefs. Consult religious leaders or advisors if unsure.

Community and Cultural Resources for Jewish Homebuyers

Support Networks

Local synagogues and Jewish community centers may offer guidance or financial workshops.

Educational Seminars and Legal Aid

Some Jewish nonprofits offer legal aid and home-buying classes tailored to cultural values.

Conclusion

While Rocket Mortgage does not offer a “Jewish loan” per se, it remains a trusted and inclusive option for Jewish borrowers seeking a mortgage in 2025. By combining Rocket’s innovative mortgage tools with support from Jewish charitable organizations, borrowers can achieve homeownership while staying true to their values.

FAQs

1. Does Rocket Mortgage offer interest-free loans for Jewish borrowers?

No, Rocket is a traditional mortgage lender and charges interest according to market rates.

2. Can I use a Jewish interest-free loan along with Rocket Mortgage?

Yes, it’s common to use JILA loans for down payments or other housing costs.

3. Is Rocket Mortgage compliant with Jewish ethical lending principles?

Rocket follows legal and ethical lending practices, but interest is charged. Consult a religious advisor for detailed guidance.

4. Does Rocket Mortgage serve Orthodox Jewish communities?

Yes, Rocket Mortgage serves borrowers of all faiths, including Orthodox Jews.

5. How can I apply for a Jewish interest-free loan?

Contact your local Hebrew Free Loan Association or Jewish Family Services.

How They Work

These loans are usually funded by community donors and repaid through a trust-based agreement. The focus is more on mutual support than commercial gain.

Does Rocket Mortgage Offer a Specific Jewish Loan Program?

Clarifying Misconceptions

Despite occasional search terms like “Rocket Mortgage Jewish Loan,” Rocket Mortgage does not offer a specific Jewish community loan. It is a secular, inclusive financial institution.

Inclusivity in Lending

Rocket Mortgage welcomes clients of all religious and cultural backgrounds and follows all fair lending laws under the Equal Credit Opportunity Act.

Jewish Community Loan Funds and Programs

Hebrew Free Loan Associations (HFLA)

There are many local HFLA organizations across the U.S., such as in New York, Los Angeles, San Francisco, and Detroit. These nonprofits offer interest-free loans for:

-

Emergency financial needs

-

Education

-

Medical expenses

-

Small business support

-

Housing assistance

Eligibility Requirements

-

Identification with the Jewish community (varies by chapter)

-

Proof of financial need

-

Co-signers may be required

-

Strong character references

Comparing Rocket Mortgage with Jewish Community Loans

Interest Rates and Loan Terms

Application Process

-

Rocket Mortgage: Online, fast, automated

-

HFLA: In-person/online, includes interviews and community vetting

When to Choose Rocket Mortgage

Conventional Home Loans

Rocket Mortgage is ideal for larger home financing needs, especially when purchasing or refinancing residential properties.

Fast Digital Approval

If speed and convenience are a priority, Rocket’s fully digital experience makes it a great choice.

When to Choose a Jewish Community Loan

Interest-Free Loans

If you need a smaller loan for down payment assistance, moving costs, or emergency home repairs, Jewish loans are an ethical and community-backed option.

Community Support and Financial Counseling

Many HFLAs offer free financial literacy programs and emotional support rooted in Jewish values.

Combining Resources for Better Home Financing

Using Jewish Loan Programs as a Supplement

Some borrowers use HFLA funds to cover down payments or reduce reliance on high-interest debt while applying for a mortgage.

Down Payment Assistance Options

Jewish charities and local synagogues may provide grants or donations for first-time Jewish homebuyers.

Jewish Values in Lending: Ethics and Support

Tzedakah and Community Assistance

Jewish loans emphasize charity, social justice, and support for fellow community members, rather than profit.

Interest-Free Lending Philosophy

Rooted in biblical teachings, interest-free loans are a form of empowerment and kindness, not financial gain.

Modern Lenders and Inclusivity

How Rocket Mortgage Supports Diverse Clients

Rocket Mortgage upholds non-discriminatory policies and supports accessibility for clients of all races, religions, genders, and backgrounds.

No Discrimination Policy

The company is regulated under U.S. laws that prohibit religious bias in lending.

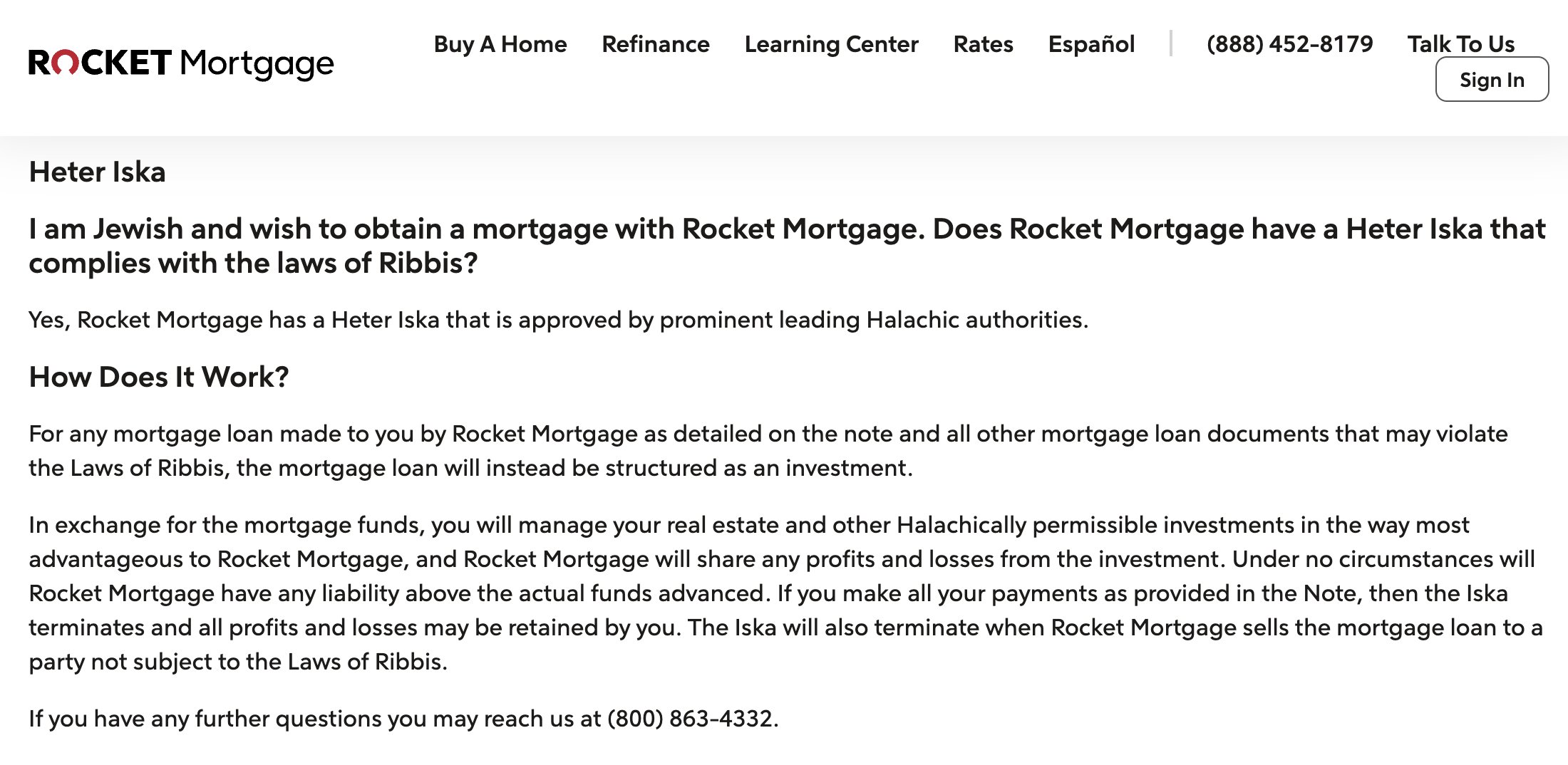

Understanding Kosher Lending Practices

Religious Perspectives on Interest

Jewish law traditionally discourages lending with interest to fellow Jews. Hence, many communities created interest-free loan organizations.

Halachic Loans vs. Commercial Loans

HFLA loans follow halacha (Jewish law), while Rocket Mortgage offers standard, commercial mortgage products that comply with U.S. financial regulations.

Financial Education in Jewish Communities

Workshops and Seminars

Jewish Federations and HFLAs often host free workshops on:

-

Budgeting for homeownership

-

Understanding credit scores

-

Managing mortgage debt

Tools for Homeownership

Some organizations offer home-buying kits and personalized financial mentoring.

Common Myths About Jewish Loans and Rocket Mortgage

Addressing Misconceptions

-

Myth: Rocket Mortgage offers Jewish-specific loans → False

-

Myth: Jewish loans are only for the poor → False

-

Myth: You must be religiously observant to qualify → Often False

How to Apply for Rocket Mortgage or a Jewish Loan

Required Documentation

For Rocket Mortgage:

-

Proof of income

-

Credit score

-

Employment history

-

Asset documents

For Jewish Loans:

-

Proof of need

-

Personal references

-

Community involvement

Steps to Qualify

-

Choose the right lender or loan association

-

Gather your paperwork

-

Complete an application (online or in person)

-

Follow up with interviews or verifications

-

Await approval and disbursement

Conclusion

While Rocket Mortgage does not offer a specific “Jewish loan,” it remains a top choice for those seeking conventional home financing. On the other hand, Jewish community loans, particularly interest-free loans from Hebrew Free Loan Associations, offer invaluable support for short-term or supplemental needs. Whether you’re navigating the home-buying journey or looking for ethical financial help, both Rocket Mortgage and Jewish loans can play a role in securing your financial future—individually or together.

FAQs

1. Does Rocket Mortgage offer Jewish loans?

No, Rocket Mortgage does not provide religious-specific loans but serves all clients equally.

2. What is a Hebrew Free Loan?

It’s an interest-free loan offered by Jewish nonprofit organizations to community members in need.

3. Can I use a Jewish loan for a home down payment?

Yes, many borrowers use Jewish loans to supplement down payments or cover closing costs.

4. Are Jewish loans only for religious Jews?

Not always. Some HFLAs help anyone in the local Jewish community regardless of observance level.

5. Can I apply for both Rocket Mortgage and a Jewish loan?

Yes, you can combine resources for better financial flexibility when purchasing a home.